[ad_1]

Adani Group stocks, especially Adani Enterprises Limited (AEL) stocks, witnessed a surge in value, resulting in Gautam Adani’s net worth surging by nearly 13%. Adani is now the 26th richest person globally.

Adani Enterprises stocks witnessed the highest surge of over 13 percent and are still trading in the green. This surge in AEL stocks has pushed Adani up in the billionaire list, making him the top winner for the third day in a row.

Adani’s net worth jump as yield-hungry investors rush into Adani stocks

After a recent slump, Adani Group stocks are on the rise again, with all Adani stocks currently trading in the green.

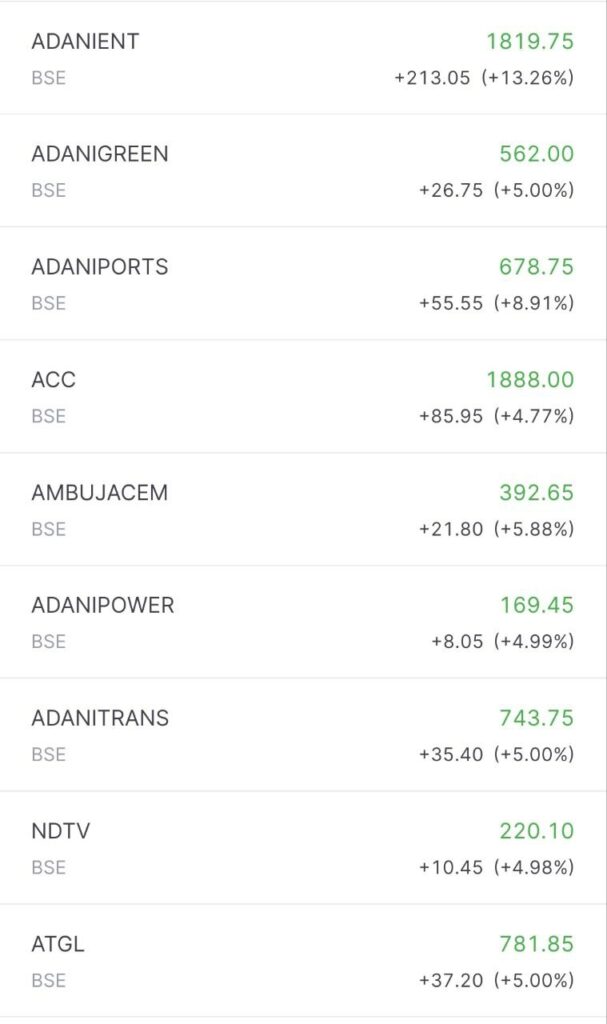

Adani Enterprises Limited (AEL), Adani Green, Adani Power, Adani Transmission, Adani Ports, ACC, Ambuja Cements, NDTV, and Adani Total Gas Limited stocks have seen an uptick.

While Adani Green, Adani Power, Adani Transmission, NDTV and Adani Total Gas are locked in their upper circuits, stocks of Adani Enterprises, Adani Ports, ACC, and Ambuja Cement witnessed a huge rise in their values.

The positive movement in Adani stocks comes after days of decline, and it has impacted Gautam Adani’s net worth. Investors are currently watching the market closely for further changes in Adani stock values.

Adani Enterprises Limited stocks surge by over 40 pc

Adani Enterprises Limited (AEL) stocks have skyrocketed by over 40 percent in the last five days, reaching Rs 1819 today from Rs 1298 on February 27.

Market experts predict that the AEL stocks may reach Rs 1900 based on technical analysis. However, this is subject to the bulls maintaining support at Rs 1400.

Any further surge in AEL stocks will result in a rise in Gautam Adani’s net worth, as it is one of the crucial companies in the Adani Group.

Reason for jump in Adani group stock prices

As per media reports, United States boutique investment firm GQG Partners has bought shares worth USD 1.87 billion in four Adani group companies.

GQG reportedly took a 3.4 percent stake in Adani Enterprises for around 662 million, 4.1 percent in Adani Ports for USD 640 million, 2.5 percent in Adani Transmission for USD 230 million, and a 3.5 percent stake in Adani Green Energy for USD 340 million

As the decision of GQG marks the first major investment in the Adani group since a short-seller’s critical report resulted in a stock rout, it boosted investors’ confidence in the group thereby leading to jump in the values of Adani stocks.

[ad_2]

#Adanis #net #worth #spikes #AEL #stocks #surge #days

( With inputs from www.siasat.com )