For many entrepreneurs, owning a home is more than a personal milestone; it symbolizes success and stability. However, the process of obtaining a home loan can be more complex for the self-employed due to their unique financial situations. Understanding the nuances of securing a mortgage as an entrepreneur is crucial for turning your dream of homeownership into reality. This News Caravan article will delve into the steps you, as an entrepreneur, can take to navigate the home loan process successfully.

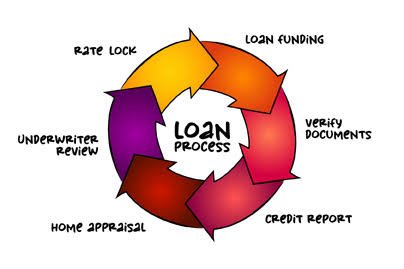

Knowing the Process – Home Loan

Grasping the intricacies of the home-buying process is critical for making informed and cost-effective decisions. Opting for “as-is” properties can be a strategic move for potential savings, as they are often priced lower. However, it’s imperative to proceed cautiously by conducting thorough inspections to preclude future expensive repairs. You also need to look at the land records and consult a legal professional before getting too deep into the process. Knowledge of each phase of the home-buying journey facilitates significant financial savings and ensures a more seamless transaction.

Keep Your Credit History Thriving

A strong credit history is crucial for loan approval, particularly for entrepreneurs. Lenders view a good credit score as a sign of financial responsibility, which is even more critical when you have a variable income. Make sure to pay your bills on time, keep your credit card balances low, and avoid taking on excessive new debts. Regularly checking your credit report for errors and addressing them promptly can also help maintain a healthy credit score.

Maintain Your Track Record

When applying for a home loan, your business’s financial health and track record are key factors that lenders evaluate. Demonstrating a pattern of consistent profitability and stable income over several years is crucial. To substantiate your business’s performance, be prepared to provide detailed financial records, such as profit and loss statements and balance sheets. A well-established business track record enhances your credibility with lenders and can be a decisive factor in securing a loan.

Create a Business Bank Account

Keeping personal and business finances distinct is essential. This separation simplifies your financial management and makes it easier for lenders to assess your loan application. Use separate bank accounts and credit cards for personal and business expenses. Clear financial boundaries can enhance your loan eligibility and potentially improve loan terms.

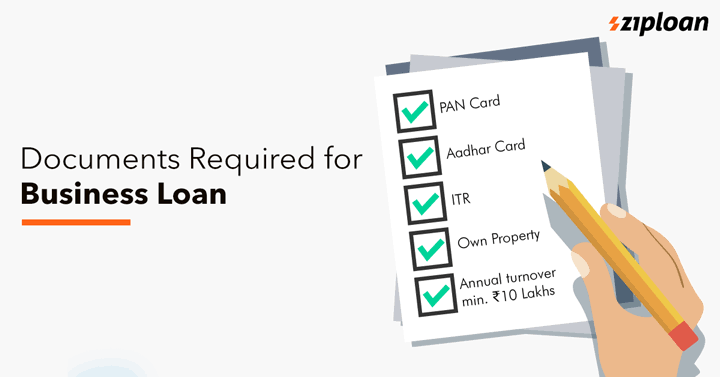

Have Your Documents Ready

Be prepared to provide extensive financial documentation when applying for a home loan. This includes personal and business tax returns, profit and loss statements, bank statements, and any other relevant financial records. These documents give lenders a clear picture of your income stability and loan repayment ability. The more comprehensive and organized your financial documentation, the smoother the loan process will be.

Speak with a Mortgage Professional

Working with mortgage professionals experienced in self-employed loans can be invaluable. They understand entrepreneurs’ challenges and can guide you through the application process. Mortgage professionals can also help you find the best loan products suited to your unique financial situation. Their expertise can be a significant asset in navigating the complexities of home loan approval.

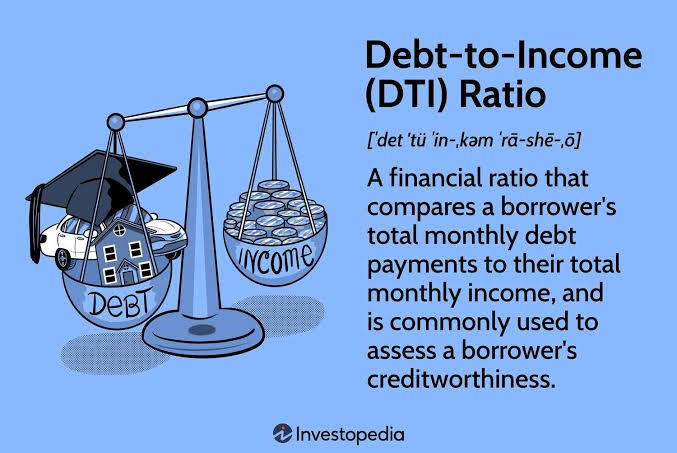

Watch Your DTI

The debt-to-income ratio is pivotal in approving your mortgage application, as it assesses your monthly debt payments relative to your income. To enhance this ratio, reduce your personal and business debts. Achieving a lower debt-to-income ratio makes you more appealing to lenders. Consequently, it can result in more advantageous loan terms, increasing your chances of approval.

As an entrepreneur, navigating the home loan process requires careful financial planning and a strategic approach. You can enhance your chances of loan approval by maintaining a strong credit history, demonstrating a solid business track record, consulting with mortgage professionals, and implementing the other tips above. Take these proactive steps toward securing your dream home, and embrace the opportunity to turn your entrepreneurial success into a personal achievement.